Why Every Financial Journey Needs a Plan

How Four Simple Words Can Help

At Four Pillars Financial Planning, we often meet people who feel confident about their finances, until they start looking closer. Many can’t answer basic questions like:

“How much do I spend each month?”

“What do I actually own?”

It’s not unusual. Most of us see our finances in fragments: income, bills, savings, pensions. But rarely do we step back and look at the whole picture. That’s where planning makes all the difference.

The Heart of Every Financial Plan

Despite what you might think, the core of a financial plan isn’t complicated. In fact, it can fit on the back of a napkin. It comes down to four simple words:

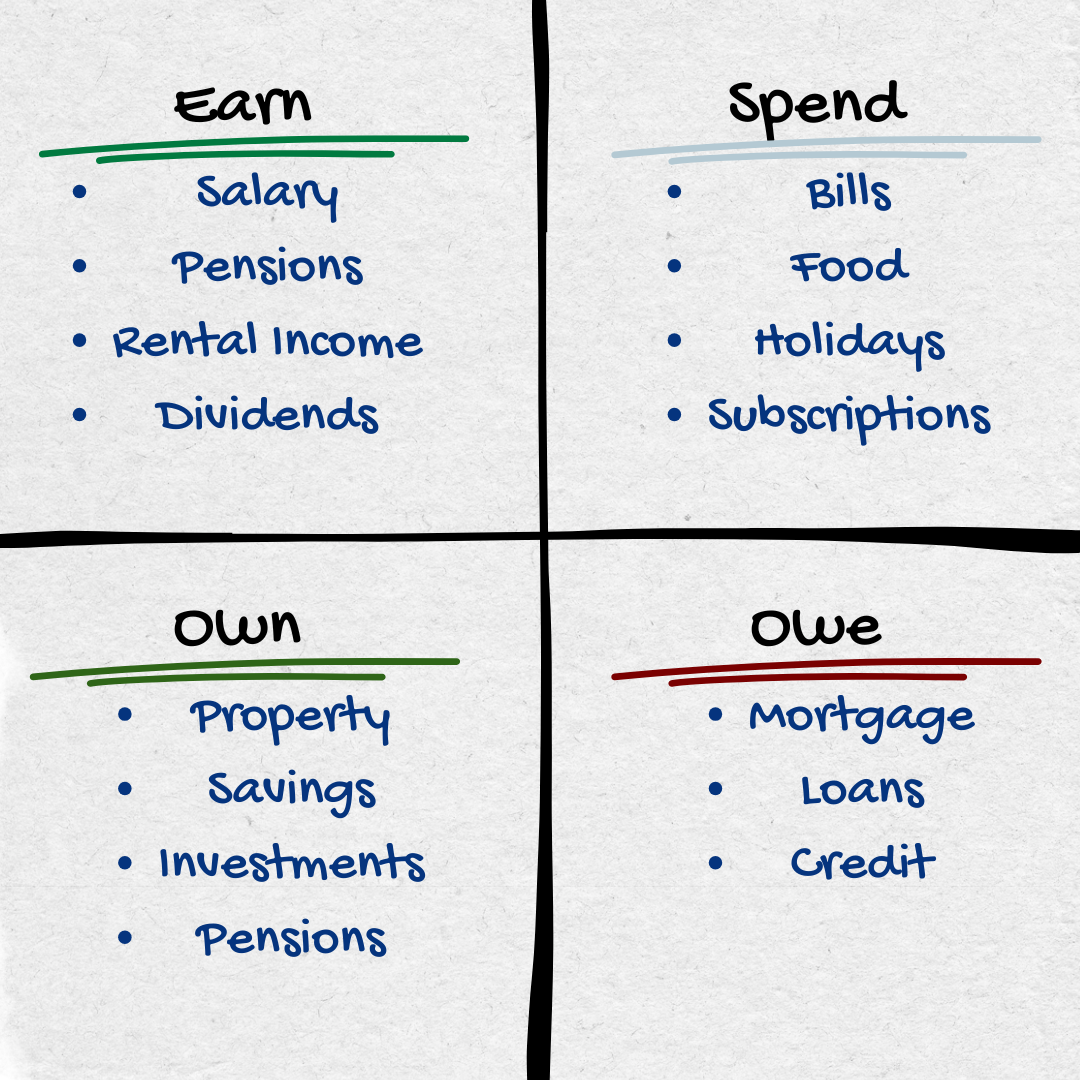

Earn. Spend. Own. Owe.

These four words represent the shape of your financial life:

Earn – Everything coming in: salary, pensions, rental income, dividends.

Spend – Everything going out: mortgage, bills, food, holidays, subscriptions.

Own – What you’ve built up: your home, savings, investments, pensions.

Owe – What you’ve borrowed: mortgages, loans, credit cards.

When you map these out, something powerful happens. You see the whole picture. Patterns emerge. Risks become clear. And that’s when the most important insight comes into focus:

When you retire, what you own will have to pay for what you spend.

The Shift That Changes Everything

For most of our working lives, we rely on what we earn to cover what we spend. But when work stops, that changes. Your income from employment shrinks, yet your spending often doesn’t, sometimes it even grows with hobbies, travel, or healthcare costs.

At that point, your future depends on what you own; your pensions, savings, and investments. If they’re not enough to support your lifestyle, you face a gap. That’s why planning ahead matters.

How Much Is Enough?

One of the most common questions we hear is:

“How much do I need for retirement?”

It’s tempting to look for a quick answer online, something like “You need £X to retire comfortably.” But here’s the truth: those numbers are averages, not your reality. They don’t know how you live, what you value, or what your future plans look like.

Instead of focusing on a generic figure, start with your spending pattern today. Ask yourself:

What does my lifestyle cost now?

What would I like to do in retirement—travel, hobbies, helping family?

Will my spending go up or down when I stop working?

This is where the conversation becomes personal. Your retirement plan should reflect your goals, not someone else’s assumptions.

For context, the Retirement Living Standards provide useful benchmarks for what a “minimum”, “moderate”, or “comfortable” retirement might cost in the UK. But these are just starting points—they’re not a substitute for a tailored plan.

Disclaimer: Figures and examples are for illustration only and do not constitute financial advice.

Why Personalised Advice Matters

Generic numbers can give you a rough idea, but they can’t tell you:

How much you’ve already built up.

How much more you need to save.

How to structure your pensions, investments, and other assets tax-efficiently.

How to protect your plan against inflation, market changes, and unexpected events.

That’s where professional advice comes in. At Four Pillars Financial Planning, we help you:

Understand your current position.

Define your future lifestyle goals.

Build a personalised roadmap to get there.

Financial planning isn’t just about picking products or chasing returns. It’s about clarity and structure, a way to connect today’s decisions with tomorrow’s goals. It’s about creating your number, based on your life.

Ready to See Your Four Boxes?

Start your journey today. Book a free initial consultation and discover how a personalised plan can give your money context and purpose.

Because when it comes to your future, the most important question isn’t:

“What do I earn today?”

It’s:

“What will I own tomorrow—and will it be enough to pay for what I spend?”