2025 in Review: Lessons to Carry Forward into 2026

As we begin 2026, it’s worth reflecting on the year just gone, a year that reminded us why patience, discipline, and perspective remain the foundations of successful investing.

A Year of Headlines and Hard Lessons

2025 was anything but quiet. It began with political change across the globe, including the inauguration of President Trump, and continued with tariff announcements that unsettled markets in the spring. At the same time, peace agreements began to de-escalate conflicts that had dominated headlines for years, while the AI revolution continued to reshape industries and capture imaginations.

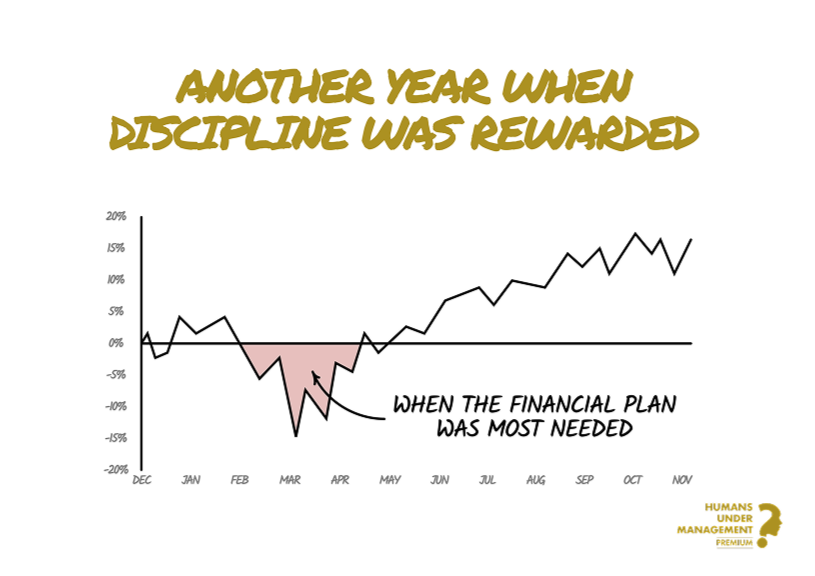

Despite periods of genuine turbulence, including a sharp decline that saw global equities fall by nearly 19%, 2025 looks set to join 2023 and 2024 as another strong year for equity investors. For those who stayed invested, the rewards were clear: global markets finished the year up around 14%.

The Spring Sell-Off: A Test of Resolve

March and April were uncomfortable months for many investors. Tariff announcements triggered a steep sell-off, and headlines were dramatic. The temptation to “do something” was strong. Yet, as history often shows, reacting to short-term volatility can be costly.

Our analysis highlights this vividly: an investor who sold in early April and re-entered in mid-May would have seen returns of just 4.8% for the year, compared with 14.4% for those who stayed invested. On a £10,000 portfolio, that’s a difference of nearly £1,000 for being out of the market for only a few weeks.*

The lesson? Timing the market is incredibly hard—and rarely works.

Three Lessons from 2025

1. Overvalued Markets Can Still Grow

At the start of 2025, many commentators warned that markets looked expensive. Yet valuations told us little about timing. Markets can remain “expensive” for years while continuing to deliver returns. Trying to wait for the perfect entry point often means missing out.

2. Knowing What Will Happen Doesn’t Tell You How Markets Will React

The tariff episode was a striking example. Everyone knew tariffs were coming. What nobody could predict was how and when the market would respond. This is why we focus on planning, not predicting.

3. Long-Term Planning Beats Short-Term Prediction

The AI revolution is transforming industries, but its ultimate impact remains unknowable. This uncertainty is not new it is the permanent condition of investing. A robust financial plan, appropriate asset allocation, and the discipline to stay invested through volatility remain the keys to long-term success.

Balance and Diversification: Timeless Principles

2025 reinforced the importance of balance. Shares provide growth potential, while bonds add stability especially with interest rates higher than in recent years. Global diversification also mattered: while US markets and AI-driven optimism dominated headlines, UK and emerging markets delivered 23%, Europe ex-UK and Japan returned 17%, compared with 11% for the S&P 500.** Holding investments across regions helps manage risk and capture opportunities worldwide.

Looking Ahead to 2026

No one can predict what 2026 will bring. Markets will rise, fall, and surprise us again. What you can control is your behaviour. Stay disciplined, keep your portfolio balanced and diversified, and remember the lessons of 2025: volatility is temporary, but your long-term goals endure.

As always, thank you for trusting us to guide you and your family. It is a privilege to serve you, and we look forward to navigating the year ahead together.

Important Information

The value of investments can go down as well as up, and you may get back less than you invest. Past performance is not a reliable indicator of future results. This article is for information purposes only and does not constitute financial advice. If you are unsure about the suitability of any investment for your circumstances, please seek advice from a qualified financial adviser.

Source:

*Global shares are represented by the MSCI All Country World Index.

**UK, emerging markets, Europe ex-UK and Japan shares are represented by their equivalent MSCI indices.