Diversification and Asset Allocation: Building a Resilient Financial Plan

When it comes to creating a robust financial strategy, two principles stand out: diversification and asset allocation. These concepts work hand-in-hand to help manage risk and support long-term goals.

What Is Diversification?

Diversification means spreading your investments across different types of assets, sectors, and regions. The aim is simple: avoid putting all your eggs in one basket. If one area of the market struggles, others may perform better, reducing the overall impact on your portfolio.

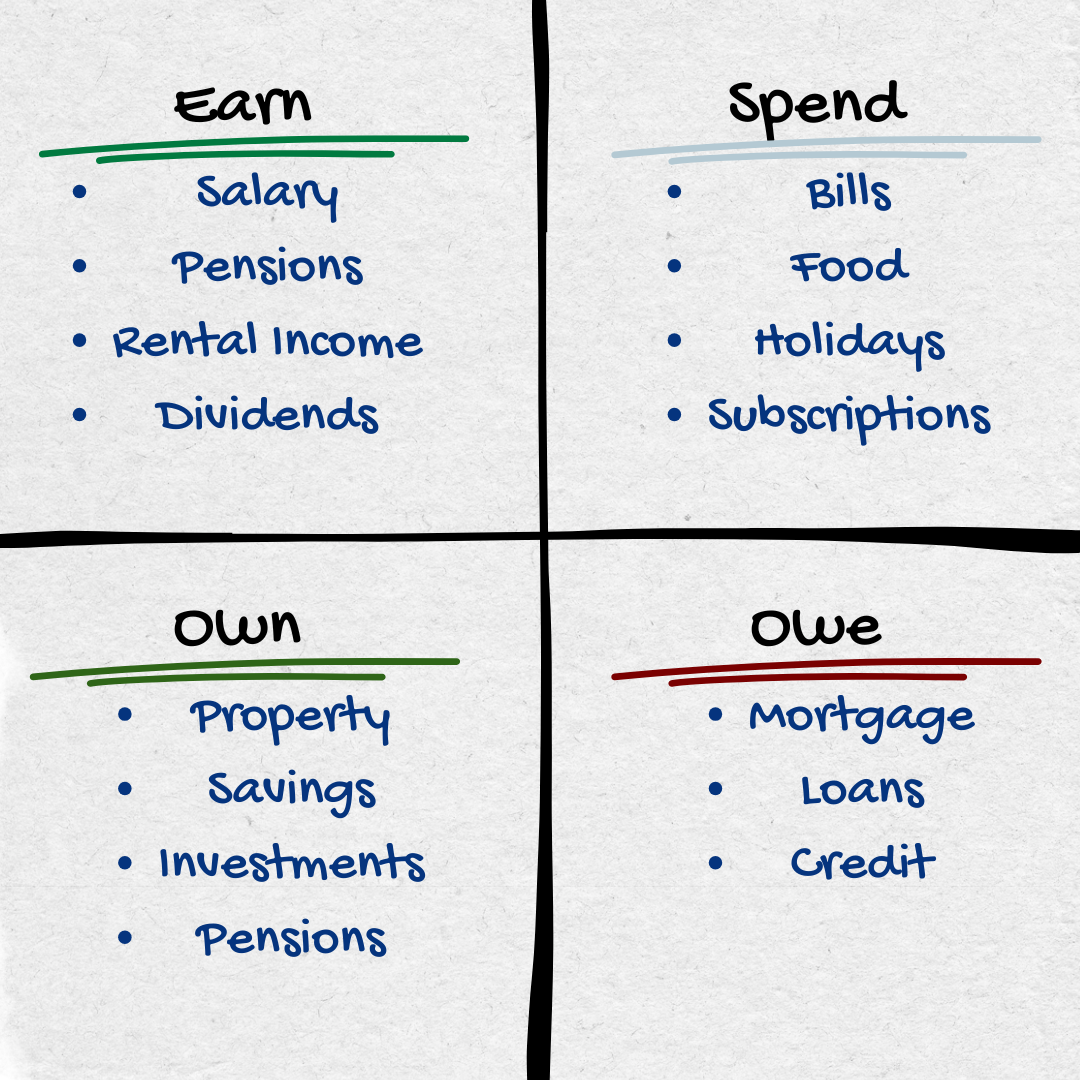

What Is Asset Allocation?

Asset allocation is the process of deciding how much of your portfolio to invest in different asset classes such as equities, bonds, property, and cash. It’s about finding the right balance between risk and return based on your:

Time horizon (how long you plan to invest)

Financial goals

Attitude to risk

For example:

A cautious investor might allocate more to bonds and cash.

A growth-focused investor might hold a higher proportion of equities.

Why Are These Principles Important?

Markets are unpredictable. Economic changes, political events, and global crises can all affect investment performance. Diversification and asset allocation aim to smooth out these ups and downs, giving you a more consistent experience over time.

Historic Performance and Perspective

History shows that different asset classes perform differently over time. For instance:

Equities have historically delivered higher long-term returns but with greater volatility.

Bonds typically offer more stability (not always the case 2022) but lower growth potential.

Cash typically provides lower than inflation returns

Physical Property (residential) provides inflation like returns

This is detailed in the chart below:

What These Strategies Are Not

They do not guarantee profits.

They do not eliminate risk entirely. Instead, they help reduce the impact of market fluctuations and keep you aligned with your long-term objectives.

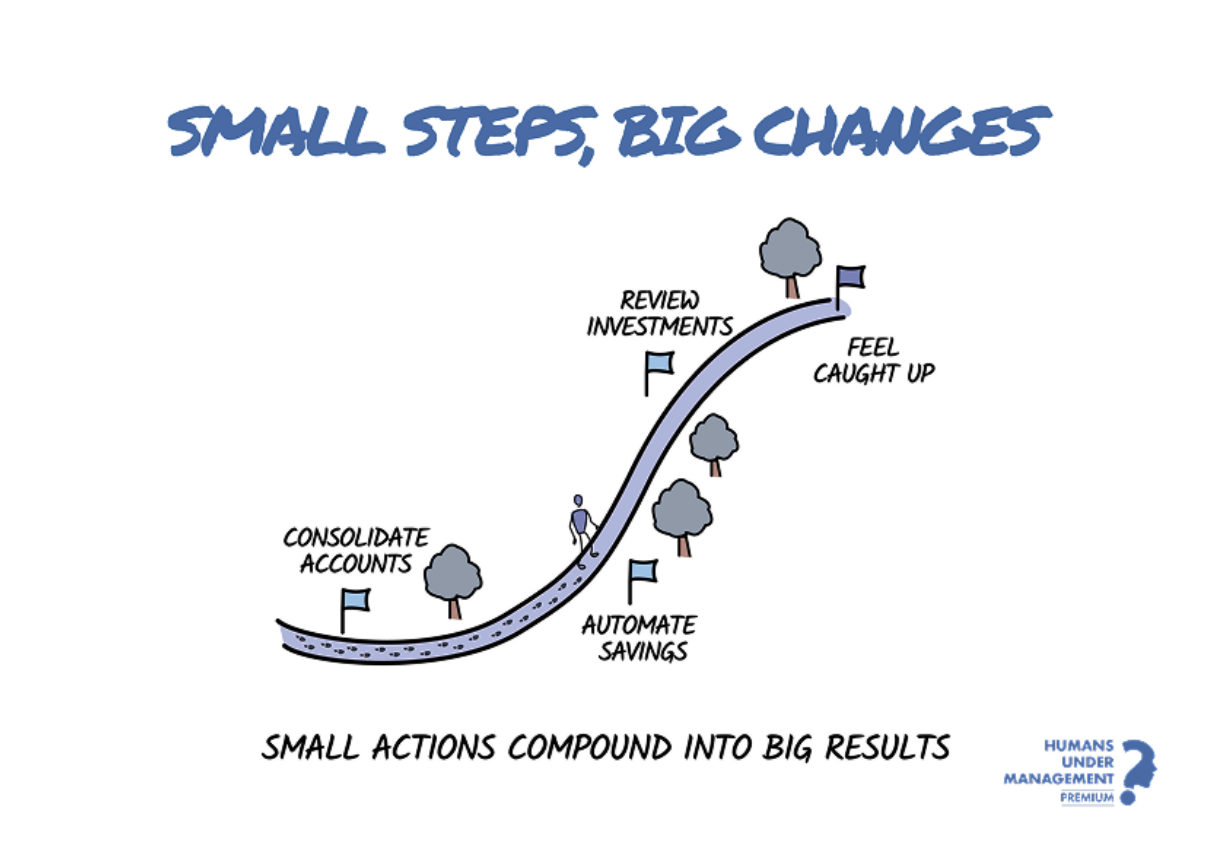

The Long-Term Perspective

Diversification and asset allocation work best as part of a disciplined, long-term financial plan. They’re about resilience, not quick wins. By spreading risk and maintaining balance, you can navigate uncertainty with greater confidence.

How we help

At Four Pillars we help you make smart, stress-free financial decisions. We’ll build a plan that fits your lifestyle, protects your future, and helps you create your financial freedom.

Get in touch today…

Important Information

The value of investments can go down as well as up, and you may get back less than you invest. Past performance is not a reliable indicator of future results. This article is for information purposes only and does not constitute financial advice. If you are unsure about the suitability of any investment for your circumstances, please seek advice from a qualified financial adviser.